Homeowners Insurance in and around San Luis Obispo

Looking for homeowners insurance in San Luis Obispo?

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

- San Luis Obispo

- Central Coast

- Santa Margarita

- Atascadero

- Paso Robles

- Templeton

- Creston

- Pozo

- Avila Beach

- Shell Beach

- Pismo Beach

- Grover Beach

- Oceano

- Arroyo Grande

- Huasna

- Nipomo

- Santa Maria

- Lompoc

- Guadalupe

- California

- Nevada

- Arizona

- Oregon

What's More Important Than A Secure Home?

Our daily plans never block time for troubles or disasters. That’s why it makes good sense to plan for the unexpected with a State Farm homeowners policy. Home insurance doesn't just protect your house. It protects both your home and your precious belongings. In the event of a tornado or a burglary, you could have damage to some of your belongings as well as damage to the home itself. Without adequate coverage, the cost of replacing your items could fall on you. Some of your possessions can be replaced if they are lost or damaged outside of your home, like if your bicycle is stolen from work or your car is stolen with your computer inside it.

Looking for homeowners insurance in San Luis Obispo?

Apply for homeowners insurance with State Farm

Don't Sweat The Small Stuff, We've Got You Covered.

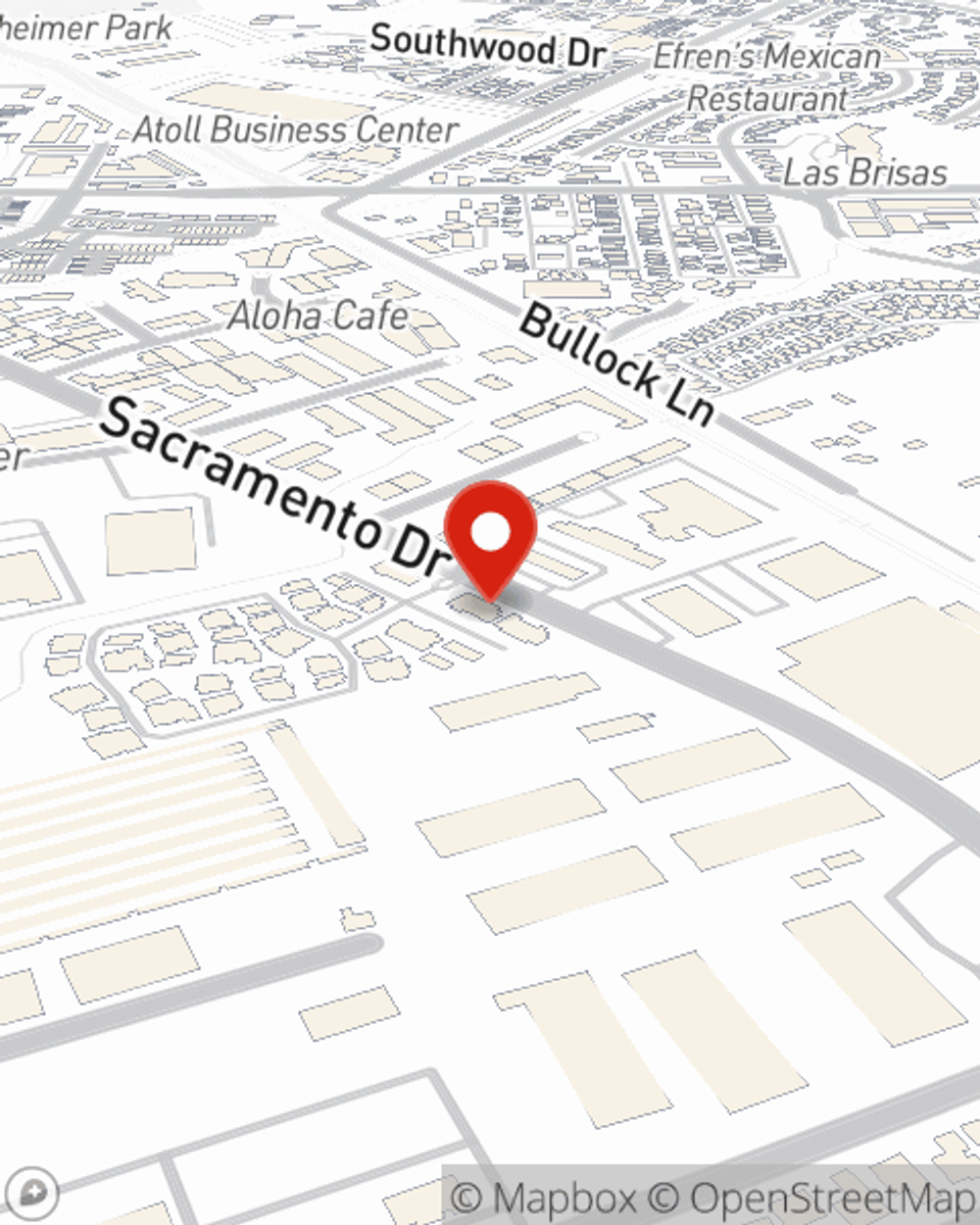

Navigating the unexpected is made easy with State Farm. Here you can construct a personalized policy or submit a claim with the help of agent Catherine Riedstra. Catherine Riedstra will make sure you get the individual, dependable care that you and your home needs.

As your good neighbor, State Farm agent Catherine Riedstra is happy to help you with understanding the policy that's right for you. Call or email today!

Have More Questions About Homeowners Insurance?

Call Catherine at (805) 466-4355 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

What causes household mold?

What causes household mold?

Here are ways to cleanup and prevent household mold.

Pros and cons of metal roofs for your home

Pros and cons of metal roofs for your home

The benefits of a metal roof may outweigh traditional asphalt shingles, especially when you consider a metal roof lifespan.

Catherine Riedstra

State Farm® Insurance AgentSimple Insights®

What causes household mold?

What causes household mold?

Here are ways to cleanup and prevent household mold.

Pros and cons of metal roofs for your home

Pros and cons of metal roofs for your home

The benefits of a metal roof may outweigh traditional asphalt shingles, especially when you consider a metal roof lifespan.