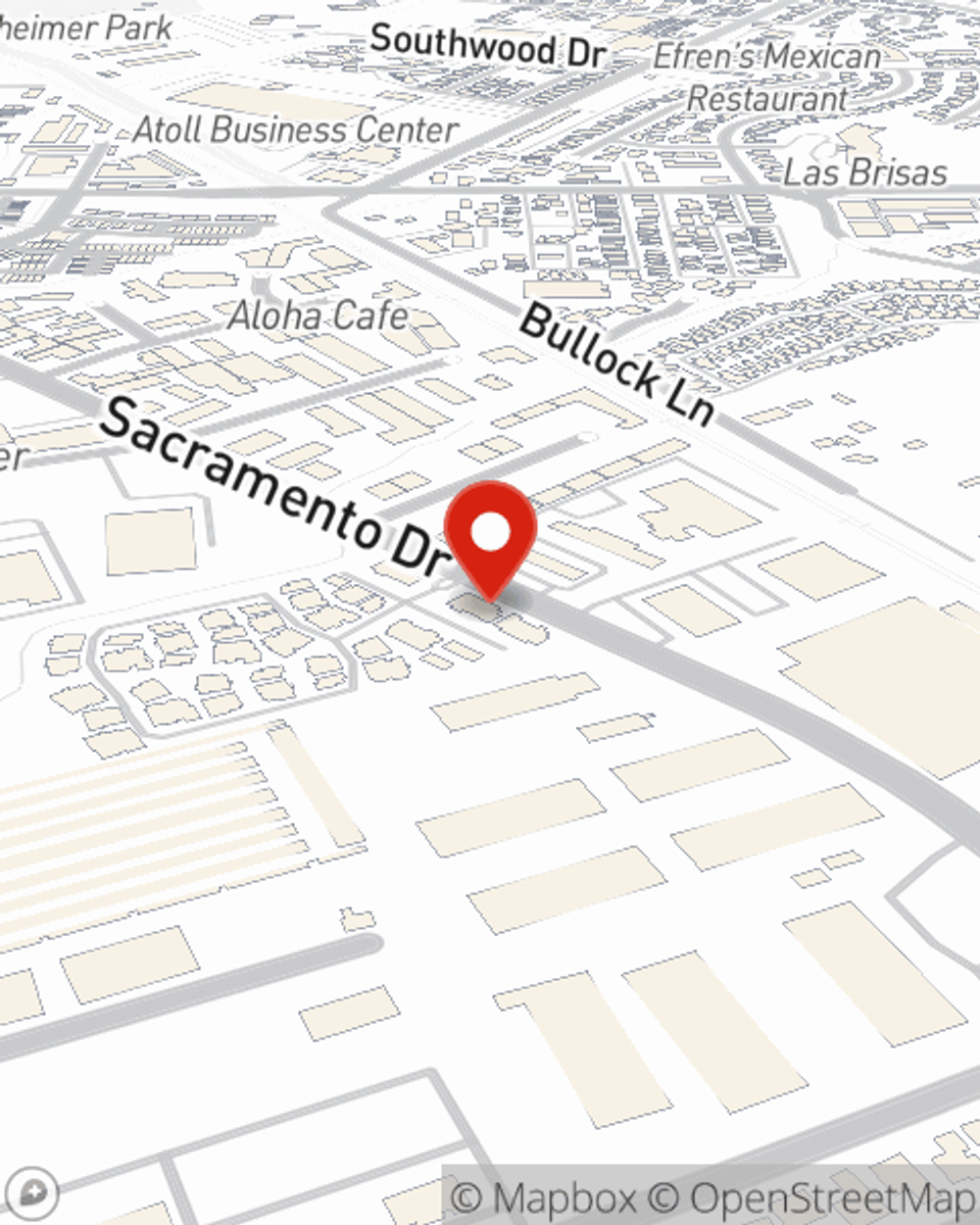

Renters Insurance in and around San Luis Obispo

Renters of San Luis Obispo, State Farm can cover you

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- San Luis Obispo

- Central Coast

- Santa Margarita

- Atascadero

- Paso Robles

- Templeton

- Creston

- Pozo

- Avila Beach

- Shell Beach

- Pismo Beach

- Grover Beach

- Oceano

- Arroyo Grande

- Huasna

- Nipomo

- Santa Maria

- Lompoc

- Guadalupe

- California

- Nevada

- Arizona

- Oregon

Protecting What You Own In Your Rental Home

Trying to sift through coverage options and deductibles on top of your pickleball league, family events and keeping up with friends, is a lot to deal with. But your belongings in your rented property may need the impressive coverage that State Farm provides. So when trouble knocks on your door, your mementos, appliances and swing sets have protection.

Renters of San Luis Obispo, State Farm can cover you

Renting a home? Insure what you own.

Why Renters In San Luis Obispo Choose State Farm

You may be doubtful that Renters insurance is really necessary, but what many renters don't know is that your landlord's insurance generally only covers the structure of the condo. What would happen if you had to replace your valuables can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when windstorms or tornadoes occur.

If you're looking for a reliable provider that can help with all your renters insurance needs, call or email State Farm agent Catherine Riedstra today.

Have More Questions About Renters Insurance?

Call Catherine at (805) 466-4355 or visit our FAQ page.

Simple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Catherine Riedstra

State Farm® Insurance AgentSimple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.